Bexio guarantees that everything is extremely easy and that the accounting and payrolling can be completed within a few clicks. Many users are encouraged to manage their accounts independently without the help of a professional, even though they have little expertise in this area. Unfortunately, this often leads to systematic errors, which then result in time-consuming and expensive clean-ups by an accountant. Here are a few tips for efficient accounting with Bexio.

Check your VAT settings

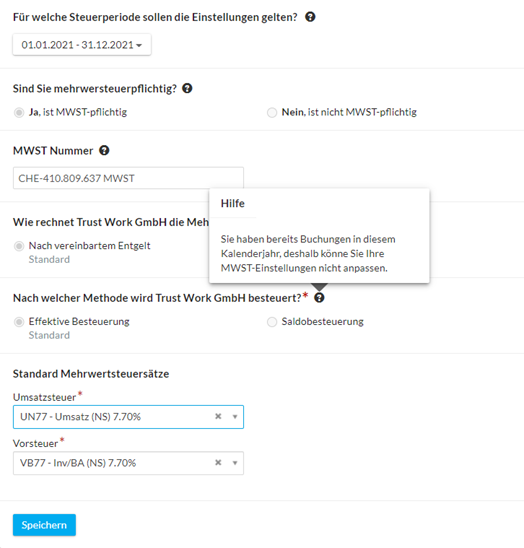

The basic VAT settings in Bexio must be configured at the beginning of each tax period. Once there are entries in the corresponding accounting year, it’s game over. It is no longer possible to adjust the settings. In this case, you have to delete all entries, then adjust the setting and enter everything again. Alternatively, the correction can also be made outside Bexio by creating the VAT declaration manually with the help of an accountant.

Configuration chart of accounts

Configuration chart of accounts

It makes sense to adapt the chart of accounts to your own needs and business model. In this way, the built-in reporting capabilities can be better utilised. However, too much excessive customisation can cause problems, as Bexio will no longer display accounts if they are incorrectly maintained. In addition, the minimum classification requirements of the Code of Obligation (CO) should be observed.

It is possible to deactivate accounts. This is recommendable for accounts that are never needed. These accounts still appear in the reports, but can no longer be used for new entries. In this way, booking errors can be avoided.

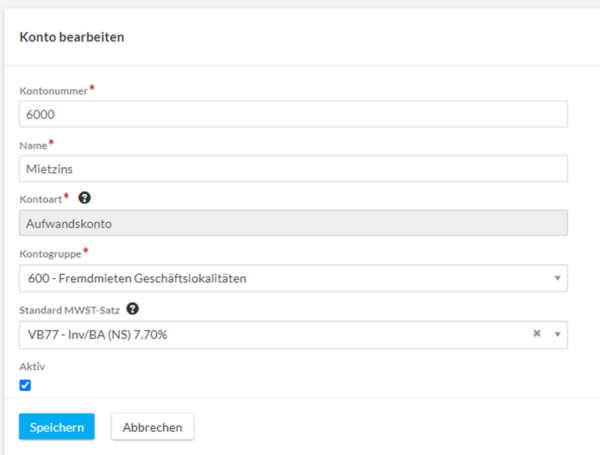

In the chart of accounts, the standard VAT rate can be saved for each account. Especially for frequently entered accounts, this is a good option, as the most frequently used VAT rate is immediately suggested in the Bexio mask. For example, it may be helpful to enter the VAT code VB77 in the account “6000 Rent”, as the lessor in this example opts for VAT on the rent.

Efficient processing of supplier invoices

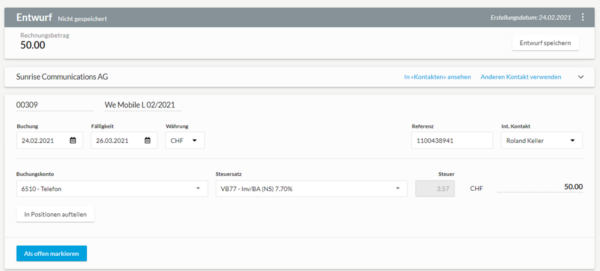

Bexio offers a reasonable accounts payable function behind the supplier invoice function in the Purchasing menu. Entering invoices can be time-consuming. Therefore, a few tips on how to efficiently enter invoices in Bexio:

- Use the copy function: for the entry of recurring invoices, copy the former invoice. In this way, most of the fields are already correctly pre-filled.

Maintain bank details with the supplier:

Maintain bank details with the supplier:

By entering the bank details once on the contact, you save having to enter the bank details for each invoice. In addition, you avoid typing errors when entering payments.- Enter payment immediately when processing the invoice:

Enter the payment immediately when posting the invoice. If you enter the payment later, you have to digitally pick up the invoice again. The payment is waiting patiently in the “Banking” module for a transfer to your bank. - Preview a PDF invoice in the preview panel of Windows Explorer:

Displaying the invoice directly in Windows Explorer makes it possible to switch from one PDF to another very quickly. You can also rename files immediately without having to close the file in PDF Reader first.

Credit card processing

Processing credit card statements can be a time-consuming task in Bexio. Entering the credit card statement as a supplier invoice is an efficient option. Each debit on the credit card statement then corresponds to an entry line in the statement. Eventually, the voucher amount must match the total of the credit card statement. This means that the reconciliation of the accounts with the bookkeeping department is done immediately.

The method has one flaw. Once you have items with reverse charge (Bezugssteuer), you must record all amounts as net items, which may result in rounding differences to the settlement.

After invoice entry, you will enter a manual payment. Choose the credit card billing account as the bank account. For this, you must first create a corresponding cash account once in the “Banking” module.

Show posting account in the supplier invoice overview

With the new entry screen in Bexio, it is possible to show the recording accounts. This will help to verify that invoices are posted correctly.

Use of the function expenses

Use of the function expenses

This function is actually very suitable for booking small items that were purchased with a Maestro card or paid privately. It is unfortunately not possible to divide an expense over several bookings, which is very annoying. This means that a large number of receipts cannot be processed correctly. For all documents that require booking to multiple expense accounts, the only way is via the “Bill” function or “Manual booking”. As a workaround, you can divide a small receipt into two “expenses”. However, the automatic comparison with the bank debit is then not working for sure. Bexio needs to improve the expense function.

Posting of social security invoices directly to personnel costs

Big problems for do it yourself accountants are the accounting of wages and social security bills. Usually it is worth paying the licence costs for the payroll module and having the module set up by qualified persons. Costs for this are much lower than tidying up the annual accounts.

The interface takes over the booking of the wages in the FIBU. Social insurance premium invoices are then to be posted to the corresponding settlement accounts. Social insurance contribution invoices are often booked directly to the expense accounts “5700 AHV, IV EO, ALV” to “5740 KTG-Beitrag”. However, it is correct to book the expense via the corresponding balance sheet accounts “2270 KK Vorsorgeeinrichtung to 2274 KK Krankentaggeld”, since the expense is already recorded by the automatic recording from payroll accounting.

Combine internal and external resources for accounting and HR in a smart way

The available resources of startups and SMEs are scarce. Therefore, it seems obvious to take care of many administrative tasks yourself and save the costs of outsourcing. But many forget the opportunity costs involved. Do it yourself bookkeeping is not free!

After all, the time spent on administrative tasks could also be spent on the further development of the product, on sales activities or on customer care. Moreover, technical errors are also likely to occur. This is why we experience time and again that Bexio users book completely wrong for a whole year to the best of their knowledge. The accountant must then spend a few hours cleaning up and correcting.

Bexio virtually invites you to carry out certain activities (e.g., accounting receivable) by yourself and to outsource others to an expert. Those who seek cooperation with a flexible trustee from the outset avoid empty runs and avoid many pitfalls.

Bexio advertises, “It’s easier with the right tools.” That is true, provided I know how to use the tool properly.

Trust Work can flexibly take over all accounting tasks and the payroll. We also provide business-focused HR services as a Professional Employer Organisation for start-ups and SMEs. Book an appointment and get a quote customised to your needs: https://www.trustwork.ch/book-a-call/